Real Estate Report

Tanking oil prices may curb surge in Dallas and Houston home price appreciation

According to the latest report from CoreLogic, Texas is still among the best states in the country for home appreciation, particularly in Houston and Dallas, which took the top two spots in the company’s latest pricing forecast.

Home prices in the Dallas-Plano-Irving metropolitan area were up 9.1 percent in November 2014 compared to the same period last year. On a month-over-month basis, home prices increased 0.7 percent from October 2014. That 9.1 percent increase landed the Dallas area at the No. 2 spot nationally.

Houston took the No. 1 spot, with a 10.6 percent increase from November 2013 to November 2014. At the state level, home prices rose 8.5 percent from November 2013, enough for a No. 3 ranking.

Home prices in the Dallas-Plano-Irving metropolitan area were up 9.1 percent in November 2014 compared to the same period last year.

Across the nation, home prices are up 5.5 percent from the same time period last year, with a month-over-month increase of 0.1 percent. All states showed a year-over-year home price appreciation in November, and the home price index (HPI) reached new highs in seven states, including Texas.

The U.S. has experienced 33 consecutive months of year-over-year increases; however, the national average is no longer posting double-digit increases. Sam Khater, deputy chief economist at CoreLogic, said in a release that prices in some states, including Texas, might dip as the energy market experiences a downward trend.

“After decelerating for most of the year, home price growth has been holding firm between a 5 and 6 percent growth rate for the last four months,” Khater said. “However, pockets of weakness are clear in Baltimore and Washington D.C., and three of the top four states with the highest price appreciation are energy intensive and had been benefiting from the energy boom, which is currently receding as oil prices trend downward.

“These states — Texas, Colorado and North Dakota — may see some downward pressure on prices in 2015.”

CoreLogic president and CEO Anand Nallathambi said that even with an expected drop in prices coming up, 2015 is forecasted to continue to show growth in housing appreciation.

“The pace of home price gains have slowed as we exit 2014, but this is probably only a temporary lull,” Nallathambi said. “While the CoreLogic HPI Forecast shows a slight dip in prices next month, we believe that prices will be up a year from now as continued economic growth fuels buyer confidence and their willingness to purchase a home and invest in their future.”

To determine the home price index, CoreLogic, a residential property information, analytics and services provider, looks at price, time between sales, property type, loan type and distressed sales. The CoreLogic HPI is a repeat-sales index that tracks increases and decreases in sales prices for the same single-family homes over time, which provides a more accurate “constant quality” view of pricing trends, as opposed to views of pricing trends based on analysis of all home sales.

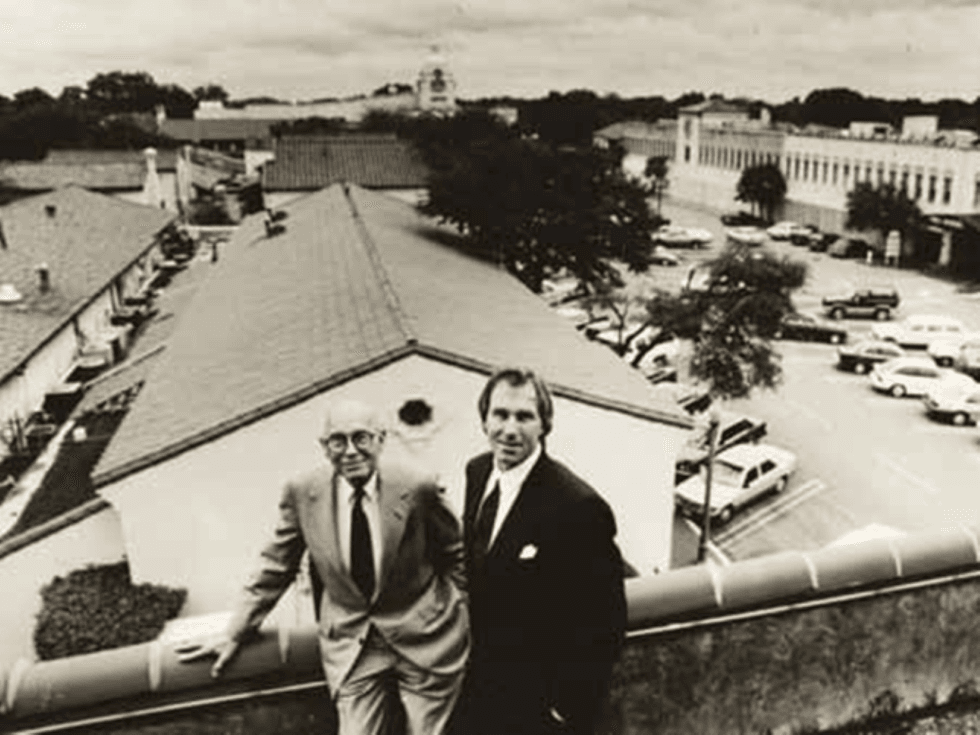

Henry S. Miller, Jr (left) with Henry III on the roof of Highland Park Village, circa early 1980's.Photo courtesy of Miller family

Henry S. Miller, Jr (left) with Henry III on the roof of Highland Park Village, circa early 1980's.Photo courtesy of Miller family