Henry S. Miller III — part of an iconic multigenerational Dallas real estate family and the visionary developer behind West Village — died February 28 of health issues. He was 79.

Born November 16, 1946, to Juanita and Henry S. Miller Jr., Miller grew up in a real estate legacy that began with his grandfather in 1914 and made the name “Henry S. Miller” synonymous with Dallas. Miller helped shape modern Dallas development while maintaining a strong emphasis on neighborhood-scale retail with West Village, a concept ahead of its time.

Long before mixed-use, walkable districts became common in North Texas, Miller erected an urban village in Uptown where shopping, dining, and residences came together to create a place to live and play. West Village opened in 2001.

“He envisioned a dense, walkable urban village where streets and plazas were alive with people, shops, restaurants, and residences — a neighborhood that blended modern city living with a human scale rarely seen in Texas at the time,” the family announcement said.

Walkability was a concept that didn’t exist in Dallas then. The approximately 400,000-square-foot development introduced a dense, walkable model that integrated retail, restaurants, multifamily housing, and public plazas at a time when Dallas development was still largely auto-centric. West Village became a template for later mixed-use projects across the region.

His family says Miller was incredibly hands-on throughout the project, working alongside co-developers, architects, planners, and community stakeholders. He viewed the development not simply as a commercial venture but as a long-term contribution to the city’s evolving urban fabric.

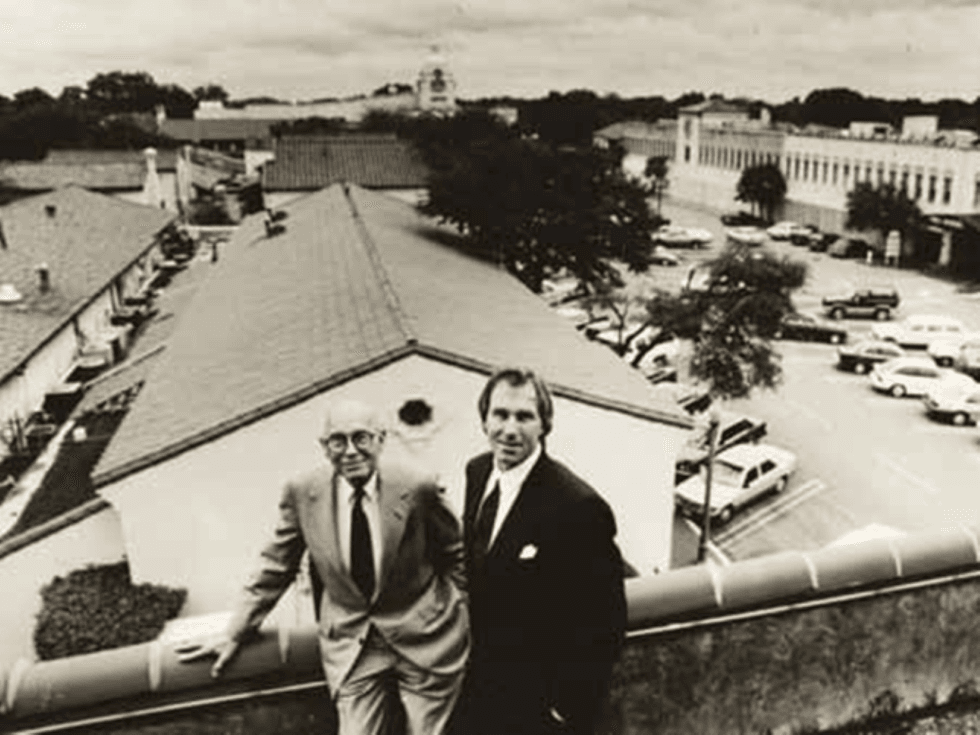

Henry S. Miller, Jr (left) with Henry III on the roof of Highland Park Village, circa early 1980's.Photo courtesy of Miller family

Henry S. Miller, Jr (left) with Henry III on the roof of Highland Park Village, circa early 1980's.Photo courtesy of Miller family

Miller also played a key role in the evolution of Highland Park Village. His father and family purchased the historic shopping center in 1976. Henry III and his father led a re-tenanting and revitalization of Highland Park Village that elevated its national retail profile while maintaining its neighborhood identity.

With his connections in fashion retail, Miller helped Highland Park Village attract luxury brands such as Prada, which did not yet have a retail presence in Dallas. The family sold the property to Ray Washburne in 2009.

His approach to neighborhood retail also shaped Preston Royal Shopping Center, originally developed in 1958 by Henry S. Miller Jr. and Trammell Crow, and was sold in 2012.

“There, he applied the same thoughtful approach — prioritizing stability, daily-use tenants, and a sense of familiarity that has served generations of families,” a family statement read. “Rather than chasing short-term trends, Henry believed centers like Preston Royal should reflect and support the surrounding neighborhoods, ensuring they remained places of convenience, connection, and community life.”

Miller earned his undergraduate degree from SMU and later completed the Advanced Management Development Program at Harvard Graduate School of Design. Over his career, he led ventures including Henry S. Miller Partners/Urban Partners and Henry S. Miller Interests Inc., and he was involved in international projects such as the Loreto Bay Company in Mexico.

Miller’s grandfather, Henry S. Miller, founded the family real estate firm as a one-man show in 1914 in Dallas. The patriarch’s son, Henry S. Miller Jr., expanded the business significantly and was involved in major retail developments such as Preston Royal and Highland Park Village. Henry S. Miller III led West Village and stewarded a revitalization of Highland Park Village with his father.

Beyond development, Miller served on the boards of the Child and Family Guidance Foundation, NEXUS Recovery Center, SPCA of Texas, The Family Place, and the Center for Performing Arts. He also mentored emerging real estate professionals through the Harvard Alumni Real Estate Board.

Miller is survived by his four children, Kathryn Miller Rabey; Henry S. Miller IV and his wife, Lydia; Michael Alexander Miller and his wife, Lindsey; and Alexander Lewis Miller. He is also survived by his sisters, Patsy Miller Donosky and Jacqueline Miller Stewart. His grandchildren include Nicholas, Maximilian, and Olivia Rabey; Henry, Jack, Owen, and Mimi Miller; and Layton Garrett, Miles, and Samuel Miller. He was preceded in death by his brother, Vance C. Miller, his father Henry S. Miller Jr., and his mother Juanita Miller.

Funeral arrangements have not yet been announced.

---

This story, by Candy's Dirt executive editor Shelby Skrhak, originally appeared on CandysDirt.com and was republished with permission.

Henry S. Miller, Jr (left) with Henry III on the roof of Highland Park Village, circa early 1980's.Photo courtesy of Miller family

Henry S. Miller, Jr (left) with Henry III on the roof of Highland Park Village, circa early 1980's.Photo courtesy of Miller family