There are about 79 million millennials in the United States, and their purchasing power is estimated to be $170 billion per year. This powerful demographic, born from the early 1980s to the early 2000s, now represents the largest group of homebuyers at 32 percent, taking over from Generation X.

But when it comes to millennial homebuyer behavior, it can be difficult to distinguish fact vs. fiction. We looked at information from a recent Pardee Homes and Builder survey, Realtor.com and the National Association of Realtors to cut through the noise.

We know that millennial homebuying behavior is different than older generations, like texting vs. calling when contacting their Realtors and extensive use of real estate apps to do their research. But what are the specific preferences of this new breed of homebuyer?

1. They’re more suburban than we thought

A lot of the recent news about millennial homebuyers paints them as urban dwellers, and maybe as renters they are. But when they are looking to buy their first home, more than half of the survey respondents said they want a suburban lifestyle. Even more surprising, they’re four times more likely to pick a bigger house over living in a more populated community.

However, even though these millennials said they want a suburban lifestyle, they want urban amenities, like the ability to walk to parks, grocery stores, schools and work.

2. Millennials crave outdoor space

Millennials cite a lot of the traditional reasons to buy a house, such as financial investment. But the “desire to have outdoor space” is the most important reason they want to purchase a home.

3. They want flexible living spaces

When millennials house hunt, 71 percent rank the ability to customize a new home as somewhat or very important. Top personalizations? A children’s play space is high on the list or a must-have to almost four out of five respondents, and 74 percent said the same thing when they were asked about having a separate living suite (think aging parents). They also value finished basements and office areas.

4. They’re considering their homes as an income source

According to the Project on Student Debt, in 2013, seven in 10 (69 percent) of graduating seniors at public and private nonprofit colleges had student loans averaging $28,400. Compare that with the average debt of approximately $15,000 (adjusted for inflation) for Gen X’s 1993 graduates.

Not surprisingly, there is a growing interest among millennials to use their new homes as a source of income. About 35 percent of those surveyed agreed that they would likely rent out a space in their home to generate income.

5. Millennials plan to customize

Part of seeing their home as an investment means spending about a fifth of their budgets on renovations and customizations to up its value. This could be important information for Realtors to know when working with them.

---

A version of this story originally was published on Candy’s Dirt.

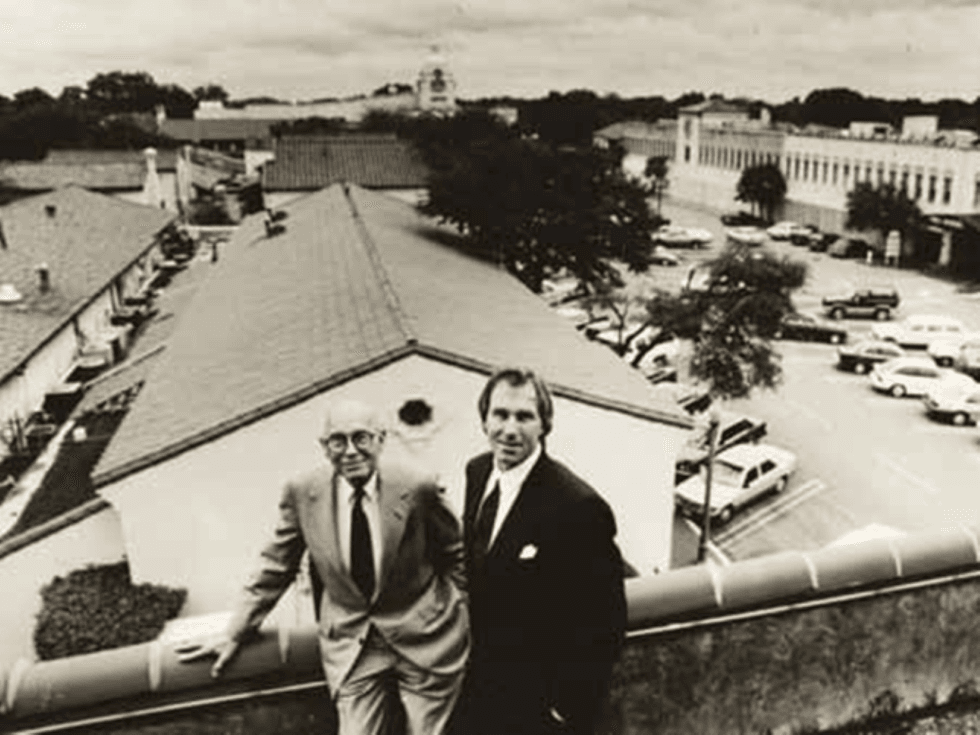

Henry S. Miller, Jr (left) with Henry III on the roof of Highland Park Village, circa early 1980's.Photo courtesy of Miller family

Henry S. Miller, Jr (left) with Henry III on the roof of Highland Park Village, circa early 1980's.Photo courtesy of Miller family